Barak UpdatesBusinessBreaking News

SBI revises ATM withdrawals & deposit charges from 1 October, click to know more

September 12: Post-demonetization, when on one hand, the government is propagating the concept of cashless or less cash, on the other, the largest nationalised bank, State Bank of India (SBI) is busy taxing its own customers. SBI has come out with details on its website regarding revision of service charges with effect from 1st October, 2019.

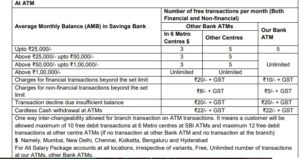

Regular savings bank account holders get eight free transactions, including five transactions at SBI ATMs and three transactions at other bank ATMs. In non-metros, such account holders get 10 free transactions, including five at SBI ATMs and five at other bank ATMs. SBI charges a fee ranging from ₹5 plus GST to ₹20 plus GST for any additional transactions beyond this limit. SBI will also charge ₹22 plus GST for cardless cash withdrawal at ATMs.

Regular savings bank account holders get eight free transactions, including five transactions at SBI ATMs and three transactions at other bank ATMs. In non-metros, such account holders get 10 free transactions, including five at SBI ATMs and five at other bank ATMs. SBI charges a fee ranging from ₹5 plus GST to ₹20 plus GST for any additional transactions beyond this limit. SBI will also charge ₹22 plus GST for cardless cash withdrawal at ATMs.

Account holders with an average monthly balance of Rs 25,000 can perform free cash withdrawal twice a month. Those with average monthly balances between Rs 25,000 to Rs 50,000 can avail 10 free cash withdrawal. Charges for transactions beyond the free limit are Rs 50 plus GST. For above Rs 50,000 up to 1,00,000, the charges are Rs 15 plus GST, while those above Rs 1,00,000 have unlimited transactions.

Account holders with an average monthly balance of Rs 25,000 can perform free cash withdrawal twice a month. Those with average monthly balances between Rs 25,000 to Rs 50,000 can avail 10 free cash withdrawal. Charges for transactions beyond the free limit are Rs 50 plus GST. For above Rs 50,000 up to 1,00,000, the charges are Rs 15 plus GST, while those above Rs 1,00,000 have unlimited transactions.

Under the revised rules,SBI has reduced the minimum average monthly balance requirement for urban centres from Rs 5,000 to Rs 3,000. This will come into effect from October 1, which means if the account holder fails to maintain the Rs 3,000 as average monthly balance and falls short by 50 % (that is Rs 1,500) then the individual will be charged Rs 10 plus GST. If the account holder falls short by more than 75%, it will invite a fine of Rs 15 plus GST to the account holder.

In semi-urban branches, SBI account holder needs to maintain an average monthly balance of Rs 2,000. If the shortfall is less than 50 per cent for semi-urban branches, then the extra charge will be Rs 7.50 plus GST. For between 50-75 per cent, the fine is Rs 10 plus GST and for above 75 per cent shortfall, the charge will be Rs 12 plus GST.

In semi-urban branches, SBI account holder needs to maintain an average monthly balance of Rs 2,000. If the shortfall is less than 50 per cent for semi-urban branches, then the extra charge will be Rs 7.50 plus GST. For between 50-75 per cent, the fine is Rs 10 plus GST and for above 75 per cent shortfall, the charge will be Rs 12 plus GST.

In rural branches, the minimum average monthly balance will be Rs 1,000. In case of AMB of Rs 1,000 at rural branches, a shortfall of less than 50 per cent , charges are Rs 5 plus GST. For shortfall of over 50 per cent up to 75 per cent, the fees will be Rs 7.50 plus GST, while shortfall over 75 percent will attract fine of Rs 10 + GST.

In rural branches, the minimum average monthly balance will be Rs 1,000. In case of AMB of Rs 1,000 at rural branches, a shortfall of less than 50 per cent , charges are Rs 5 plus GST. For shortfall of over 50 per cent up to 75 per cent, the fees will be Rs 7.50 plus GST, while shortfall over 75 percent will attract fine of Rs 10 + GST.

As per the reports, the National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) charges are also set to change. However, NEFT and RTGS transactions through digital means are free, fees are imposed at branches. NEFT transaction up to Rs 10,000, will invite Rs 2 plus GST charges. For a transaction above Rs 2 lakh via NEFT, the bank will charge the holder Rs 20 plus GST.

As per the reports, the National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) charges are also set to change. However, NEFT and RTGS transactions through digital means are free, fees are imposed at branches. NEFT transaction up to Rs 10,000, will invite Rs 2 plus GST charges. For a transaction above Rs 2 lakh via NEFT, the bank will charge the holder Rs 20 plus GST.

For RTGS transfer between Rs 2 lakh to Rs 5 lakh, a customer must pay Rs 20 plus GST. RTGS transfer above Rs 5 lakh will be charged Rs 40 plus GST. As per the new charges on Deposits and Withdrawals, cash deposits in a savings account will be free for up to 3 transactions in a month. After which the account holder will be charged Rs 50 plus GST for every transaction.

For RTGS transfer between Rs 2 lakh to Rs 5 lakh, a customer must pay Rs 20 plus GST. RTGS transfer above Rs 5 lakh will be charged Rs 40 plus GST. As per the new charges on Deposits and Withdrawals, cash deposits in a savings account will be free for up to 3 transactions in a month. After which the account holder will be charged Rs 50 plus GST for every transaction.